Open Doorway Financial loans and doorstep money lending have obtained recognition as convenient and flexible possibilities for individuals in need of brief fiscal aid. These sorts of lending companies allow for borrowers to entry funds without needing to experience the traditional, usually prolonged, financial loan application procedures linked to banks or other substantial economical institutions. Even though the enchantment of these loans may possibly lie of their simplicity and accessibility, it’s important to completely have an understanding of the mechanisms, rewards, and opportunity pitfalls in advance of thinking about this type of monetary arrangement.

The thought powering open door financial loans revolves all-around furnishing effortless and rapidly use of money, commonly without the will need for extensive credit rating checks or collateral. This will make these financial loans interesting to individuals who may well not have the very best credit history scores or individuals who deal with money difficulties. In contrast to conventional financial loans which will get times and even months being accredited, open door loans typically deliver funds to the borrower’s account in a make any difference of several hours. This pace and convenience are two in the most important variables contributing for the escalating attractiveness of these lending expert services.

The process of making use of for these financial loans is simple. Normally, borrowers have to have to offer primary personalized facts, evidence of earnings, and financial institution details. Because open door financial loans are frequently unsecured, lenders tackle extra danger by not necessitating collateral. Therefore, the interest charges and fees affiliated with these financial loans are generally increased in comparison to traditional lending options. While This may be a downside, the accessibility and velocity of funding often outweigh the upper costs For several borrowers in urgent money circumstances.

Doorstep income lending, as being the identify indicates, involves the supply of money on to the borrower’s home. This assistance is meant to cater to Those people who prefer in-man or woman transactions or individuals that might not have entry to on-line banking services. A consultant within the lending firm will visit the borrower’s house handy in excess of the cash and, in several conditions, collect repayments on a weekly or monthly foundation. This own contact can offer a way of reassurance to borrowers, Primarily individuals that may very well be cautious of on the internet transactions or are much less aware of digital economical expert services.

Having said that, one particular should take into account the higher curiosity rates and charges normally linked to doorstep hard cash lending. A lot of these financial loans are considered significant-hazard by lenders, offered that they are unsecured and that repayment assortment relies upon greatly on the borrower’s ability to make payments with time. Thus, the curiosity prices charged could be drastically higher than These of normal financial loans. Borrowers need to be careful of the, as being the ease of doorstep money lending may well come at a considerable Charge.

A further factor to think about is definitely the repayment overall flexibility that these financial loans offer you. Several open up door financial loans and doorstep hard cash lending services offer flexible repayment selections, which can be beneficial for borrowers who might not be in a position to decide to strict payment schedules. However, this overall flexibility may also result in extended repayment periods, which, combined with superior desire costs, can cause the borrower to pay considerably much more above the lifetime of the loan than they initially borrowed. It’s imperative that you evaluate whether the repayment structure of such financial loans is actually manageable and consistent with 1’s money problem prior to committing.

Among the list of important components of open door financial loans is their skill to accommodate folks with very poor credit rating scores. Conventional banks frequently deny financial loans to People with significantly less-than-fantastic credit rating histories, but open up doorway lenders usually concentrate additional over the borrower’s existing capacity to repay as an alternative to their credit history earlier. Even though this can be beneficial for anyone seeking to rebuild their fiscal standing, it’s critical to be mindful with the dangers associated. Failing to satisfy repayment deadlines can further more harm one’s credit rating and likely cause extra severe monetary troubles down the line.

The acceptance system for these loans is usually speedy, with decisions made in a several hrs, and cash are sometimes out there the identical working day or the subsequent. This immediacy helps make these loans a lifeline for folks dealing with sudden costs or emergencies, which include car repairs, healthcare expenses, or other unforeseen economical obligations. On the other hand, the ease of use of funds can sometimes lead to impulsive borrowing, which could exacerbate fiscal troubles rather then resolve them. Borrowers must constantly contemplate whether they definitely will need the personal loan and should they will be able to afford to pay for the repayments prior to proceeding.

Yet another advantage of doorstep cash lending is it lets borrowers to get dollars with no need to have to visit a lender or an ATM. This may be notably useful for those who might are in remote places or have confined use of money establishments. Furthermore, some borrowers could come to feel far more relaxed addressing a consultant in human being, particularly if they may have concerns about dealing with economical transactions on-line. The non-public character of your assistance can foster a stronger relationship concerning the lender and the borrower, but it surely is critical to keep in mind that the superior price of borrowing continues to be an important thing to consider.

There is certainly also a certain volume of discretion associated with doorstep cash lending. For individuals who may well not want to disclose their economic scenario to Many others, a chance to take care of personal loan arrangements in the privacy of their home is often appealing. The private interaction that has a lender representative may additionally supply some reassurance, as borrowers can focus on any concerns or concerns straight with the individual offering the bank loan. This direct interaction can from time to time make the lending system feel much less impersonal than managing a faceless on the internet software.

On the draw back, the convenience of doorstep money lending can at times produce borrowers having out several financial loans at the same time, especially if they discover it demanding to help keep up with repayments. This could develop a cycle of personal debt that is definitely hard to escape from, significantly In case the borrower isn't taking care of their funds carefully. Responsible borrowing and a transparent idea of the personal loan conditions are vital to steer clear of these predicaments. Lenders may well give repayment designs that appear flexible, even so the substantial-fascination premiums can accumulate swiftly, leading to a big financial debt stress after some time.

Though open up door financial loans and doorstep money lending offer many Added benefits, for example accessibility, velocity, and suppleness, they are not devoid of their issues. Borrowers should meticulously evaluate the stipulations of such loans in order to avoid obtaining caught within a personal debt cycle. The temptation of brief income can at times overshadow the extensive-phrase economical implications, specifically if the borrower will not be in a powerful place to help make timely repayments.

One of the first considerations for any borrower must be the whole pay weekly doorstep loans cost of the bank loan, which include fascination rates and any extra fees. Though the upfront simplicity of such loans is desirable, the actual amount repaid with time is usually drastically higher than expected. Borrowers must weigh the immediate benefits of getting hard cash speedily from the prolonged-term economical influence, particularly Should the bank loan conditions lengthen over a number of months or perhaps decades.

Furthermore, borrowers also needs to concentrate on any potential penalties for late or skipped payments. A lot of lenders impose steep fines for delayed repayments, which may additional enhance the total expense of the personal loan. This can make it even more significant for borrowers to make certain they have a sound repayment prepare in position ahead of getting out an open up door bank loan or choosing doorstep funds lending.

Regardless of the opportunity negatives, you will discover eventualities exactly where open up doorway loans and doorstep hard cash lending may be valuable. For people who need usage of funds quickly and would not have other feasible economic choices, these financial loans provide an alternate that will help bridge the gap all through hard occasions. The key is to make use of these loans responsibly and make sure that they are part of a well-thought-out monetary system in lieu of a hasty choice driven by rapid needs.

In some instances, borrowers may perhaps find that these loans serve as a stepping stone to a lot more steady money footing. By making well timed repayments, individuals can exhibit fiscal accountability, which may strengthen their credit rating scores and allow them to qualify For additional favorable personal loan phrases Later on. On the other hand, this consequence relies upon intensely around the borrower’s power to take care of the personal loan successfully and avoid the pitfalls of higher-interest credit card debt.

It’s also value noting that open up doorway loans and doorstep income lending are sometimes subject to regulation by financial authorities in several nations. Lenders must adhere to specified suggestions with regards to transparency, curiosity premiums, and repayment phrases. Borrowers should guarantee that they're managing a authentic and controlled lender in order to avoid possible ripoffs or unethical lending techniques. Examining the lender’s credentials and looking at reviews from other borrowers will help mitigate the potential risk of falling sufferer to predatory lending techniques.

In conclusion, open up doorway financial loans and doorstep funds lending provide a hassle-free and available solution for individuals going through rapid fiscal worries. Though the convenience of acquiring these loans can be attractive, it’s vital to method them with warning and a transparent idea of the involved prices and challenges. Borrowers need to carefully Examine their ability to repay the personal loan in the agreed-upon conditions and concentrate on the possible extensive-term fiscal penalties. By doing so, they can make knowledgeable conclusions that align with their monetary ambitions and stay away from the frequent pitfalls of superior-desire lending.

Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Jennifer Love Hewitt Then & Now!

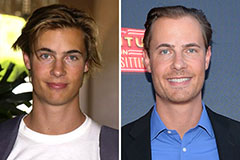

Jennifer Love Hewitt Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!